You provide risk capital.

We help you reduce risk and better ensure impact.

You are in the business of providing risk capital. We are in the business of providing secure, easy-to-use, cloud-based software that helps ensure key risks are identified, assessed, managed and monitored across evaluation, funding, delivery and feedback cycles. The result? Monies are more effectively channeled, risks are anticipated and addressed early and, most importantly, desired impacts are achieved with greater efficiency and at lower cost.

1

The context

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation.

2

Challenges

Grantees often end up trying to close the gap.

3

Positive trends

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation.

Better understand and address key connections between funding, desired impacts, risks and controls

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

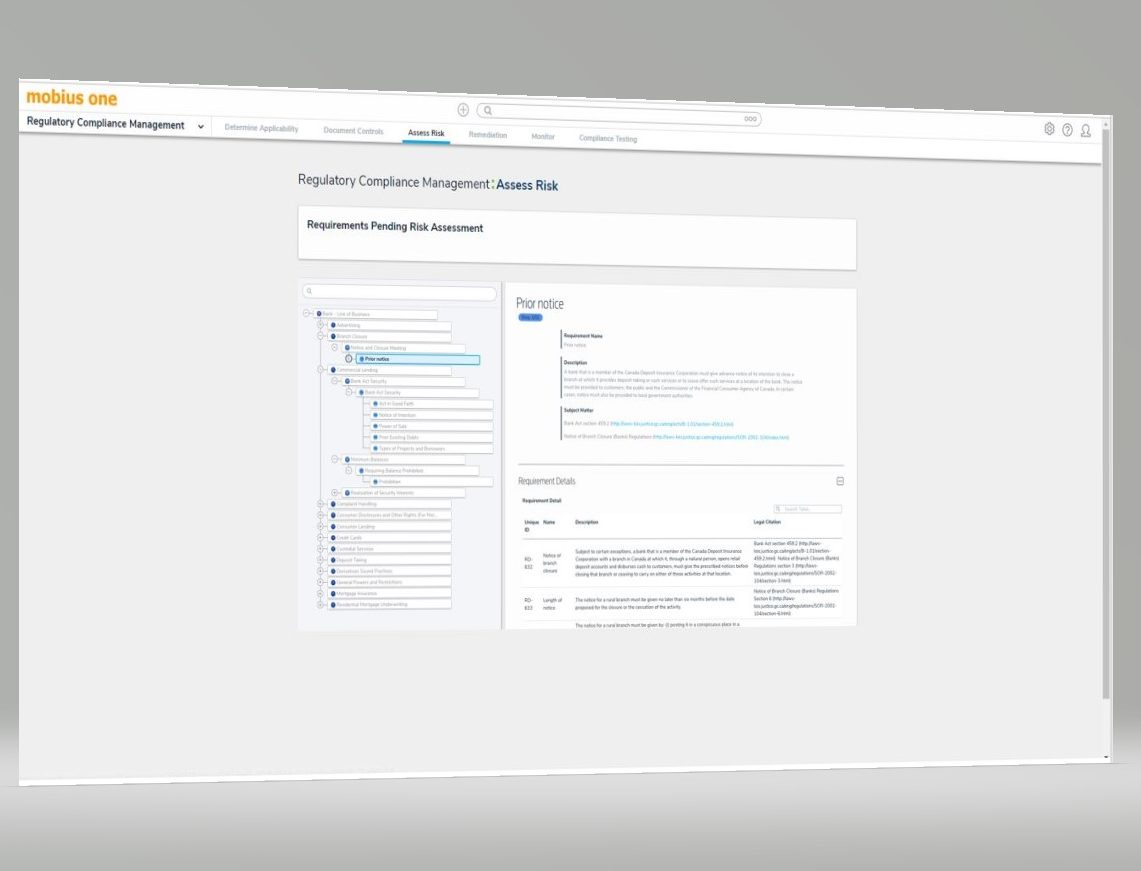

The Mobius ONE Platform

You are in the business of providing risk capital. We are in the business of providing secure, easy-to-use, cloud-based software that helps ensure that key risks are identified, assessed, managed and monitored across your funding, delivery and feedback cycles. The result? Monies are more effectively channeled, risks are anticipated and addressed early and, most importantly, desired impacts are achieved with greater efficiency and at lower cost.

Integrated planning and governance = improved outcomes and lower risk

With the goal of enabling alignment and integration spanning ERM, regulatory compliance, internal audit and future application areas, we’ve employed a database design that offers unparalleled flexibility, scalability and performance.

Providing a clear line-of-sight

Our application enables a top-down approach to scoping in relevant lines of business, risk ranking relevant regulations and then documenting and testing related controls. Curated content, aligned to your lines of business, includes the Credit Unions and Caisses Populaires Act, , FATCA, Employment Standards Act, Canadian Anti-Spam Legislation, AML/ATF legislation, and more.

Thinking of going federal? We can help there, too.

An assurance strategy, based upon the key risks facing your organization

The combined risk insights of the organization can now serve as a foundation for a comprehensive and aligned assurance strategy. Better inform your internal audit plan and gain confidence that your organization’s assurance coverage is both comprehensive and efficient.

Let us help you move the needle

You and your grantees are in this together – to help make a difference. Our platform will enable you to have the conversations (and data) to proactively address risks and achieve desired impacts.

Don’t Ask, Won’t Tell

Percentage of funders that did not ask potential grantees about possible risks to the project during the application process.

Source: Open Road Alliance Survey

an uncomfortable discussion?

Percentage of grantees that reported feeling comfortable discussing possible contingencies — i.e., risks — during the grant application process, and the comfort level dropped to only 52 percent after an award was made.

awards

Arrange for a demo

We’d be delighted to discuss your requirements and then arrange for a demo, tailored to your needs. Simply fill out this brief form and we’ll contact you to arrange a convenient time. Thanks.